The decentralized finance (DeFi) space is evolving rapidly, and Raydium Swap has emerged as a trailblazer on the Solana blockchain, offering a potent mix of speed, innovation, and user empowerment. Here’s a deep dive into what makes Raydium Swap a standout platform for traders and liquidity providers:

1. Solana’s Infrastructure: The Backbone of Efficiency

Raydium leverages Solana’s high-throughput blockchain to deliver near-instant transactions and microscopic fees (often less than $0.01). This eliminates the bottlenecks plaguing Ethereum-based DEXs, making Raydium ideal for high-frequency traders and cost-conscious users.

2. AI-Optimized Yield Farming

Raydium’s proprietary AI algorithms analyze market trends to auto-optimize liquidity pools and staking strategies. This “smart yield” feature helps users maximize returns without constant manual adjustments, appealing to both passive earners and seasoned farmers.

3. Aggregated Liquidity via Serum Integration

Unlike traditional AMMs, Raydium taps into Serum’s central limit order book, pooling liquidity across the Solana ecosystem. This ensures deeper liquidity and tighter spreads, even for large trades or less popular token pairs.

4. User-Friendly Innovation

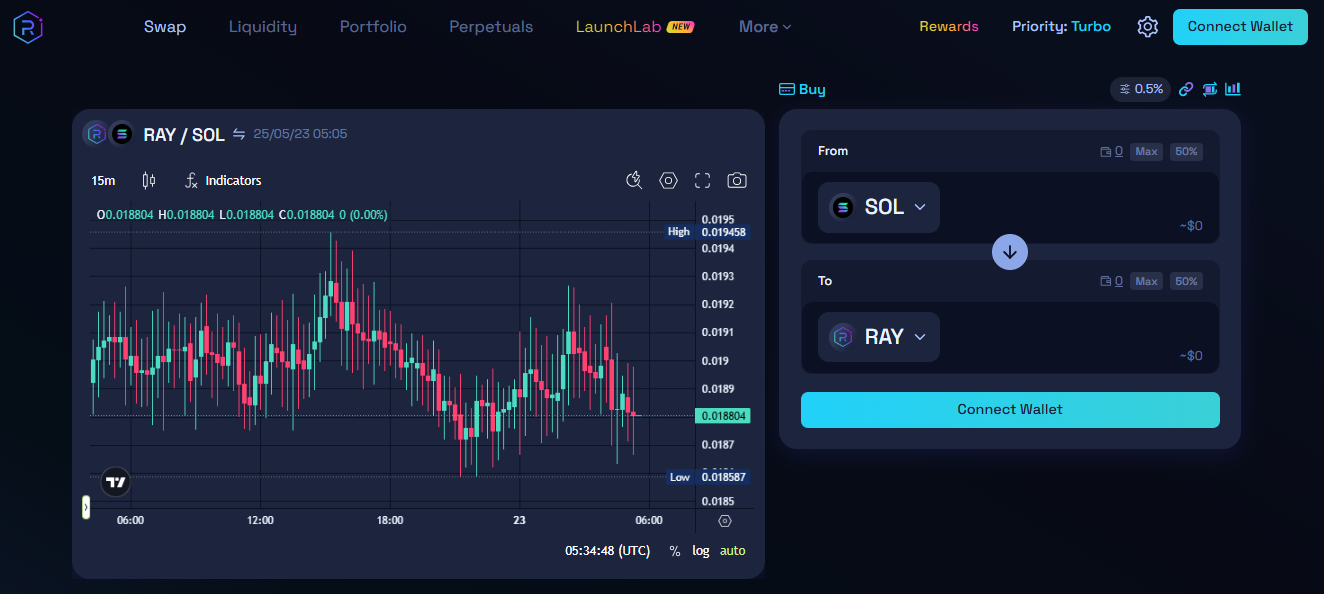

The platform balances simplicity with advanced tools:

-

Limit orders and slippage controls for precise trading.

-

Real-time analytics dashboards for LP providers.

-

A clean interface that caters to DeFi newcomers.

5. Security & Decentralized Governance

Raydium prioritizes safety with audited smart contracts and a community-driven governance model. Token holders can propose or vote on upgrades, ensuring the platform evolves with its users’ needs.

The Verdict

While competitors like Orca and Jupiter excel in specific niches, Raydium Swap’s fusion of AI-driven strategies, Solana’s speed, and cross-protocol liquidity creates a uniquely efficient DeFi experience. Its focus on democratizing advanced tools for everyday users positions it as a leader in the next wave of decentralized trading.

Ready to experience the future of DeFi? Dive into Raydium Swap and join a platform where speed, intelligence, and community collide.