global Nano Silicon for Lithium Battery market is entering a phase of remarkable growth, driven by the pressing need for higher energy storage, longer battery life, and fast-charging capabilities. In 2024, the market stood at USD 54.6 million and is projected to soar to USD 346 million by 2031, expanding at a CAGR of 30.6%. This rapid rise reflects the transition from conventional graphite-based anodes to silicon-based solutions, especially in next-generation electric vehicles (EVs), consumer electronics, and energy storage systems.

Understanding Nano Silicon for Lithium Battery

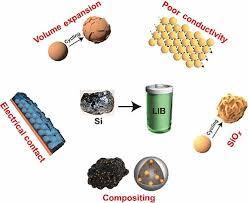

Nano silicon refers to engineered silicon materials at the nanoscale (typically below 150 nm) used in lithium-ion battery anodes. Compared to traditional graphite, which offers a theoretical capacity of ~372 mAh/g, nano-silicon can deliver capacities as high as 4,200 mAh/g. However, challenges such as silicon's expansion during lithium intercalation have historically limited its utility. Nano-structuring solves these issues by controlling particle morphology, improving cycle life, energy density, and charging speed, thereby redefining battery performance standards.

Request a Free Sample Copy : https://www.intelmarketresearch.com/download-free-sample/862/Nano%20-Silicon-for-Lithium-Battery-Market

Market Dynamics

Key Growth Drivers

1. Surging Demand from Electric Vehicles (EVs):

As EV adoption accelerates globally—forecasted to grow at over 23% CAGR through 2030—the need for high-capacity batteries becomes increasingly urgent. Nano silicon enables lighter batteries with increased driving ranges, directly supporting the evolution of long-range EV platforms by automakers such as Tesla, BYD, and Mercedes-Benz.

2. Advances in Nanomaterial Engineering:

Breakthroughs in processing methods like plasma-enhanced chemical vapor deposition (PECVD), atomic layer deposition, and laser ablation are allowing for precise control over silicon particle structures. Additions such as carbon coatings and elastic binders are stabilizing performance, reducing degradation during charge-discharge cycles.

3. Integration with AI and IoT Energy Platforms:

Next-generation energy storage systems, particularly for smart grids and residential solar setups, are increasingly reliant on batteries with greater intelligence, efficiency, and compactness—areas where nano silicon is gaining traction.

4. Strategic Collaborations and OEM Partnerships:

Battery material manufacturers are aligning with EV giants and consumer tech firms, facilitating faster commercialization. Joint ventures and long-term supply contracts are ensuring streamlined integration into next-gen battery ecosystems.

Restraints to Market Growth

1. High Manufacturing Costs:

Producing nano-silicon is significantly more complex and costly than graphite. Techniques required to synthesize nano-silicon—especially at commercial scales—demand high energy and specialized equipment, leading to production costs that are nearly 5 times higher than graphite-based alternatives.

2. Volatility in Raw Material Prices:

The cost of high-purity silicon feedstock has shown fluctuations of over 30% annually, making long-term planning and cost forecasting difficult for both battery manufacturers and OEMs.

Emerging Opportunities

1. Silicon-Dominant Battery Architectures:

Innovative architectures featuring 100% silicon anodes have achieved energy densities above 400 Wh/kg, attracting interest from sectors like aerospace, defense, and luxury EVs.

2. Policy-Driven Localization of Supply Chains:

Supportive legislation such as the U.S. Inflation Reduction Act and EU Battery Regulation Directive are pushing for domestic material sourcing. This shift is benefiting local nano-silicon producers and fostering regional innovation hubs.

3. Residential and Commercial Storage Expansion:

The growth in off-grid energy systems and smart home solutions is creating demand for high-density, fast-charging batteries. Nano silicon is expected to play a pivotal role in meeting this demand due to its superior energy-to-weight ratio.

Key Challenges

1. Cycling Instability and SEI Breakdown:

Despite engineering improvements, solid electrolyte interphase (SEI) instability during cycling remains a technical bottleneck. Methods like artificial SEI formation and electrolyte additives are promising but not yet universally effective beyond 500–700 cycles.

2. Industry-Wide Standardization Issues:

The lack of standardized performance benchmarks due to the diversity in silicon formulations—such as porous silicon, silicon nanowires, and carbon-silicon blends—slows down large-scale OEM adoption.

Regional Outlook

North America:

A hub for technological innovation, the region is boosted by strong government incentives and the presence of major players like Sila Nanotechnologies and Ionic Mineral Technologies. Federal policy support for domestic battery production is aiding the rise of local supply chains, although high CAPEX remains a barrier.

Europe:

With countries like Germany, France, and the UK leading the way, Europe’s strict emissions regulations and robust R&D funding have fostered a strong nano-silicon ecosystem. EU-backed projects under Horizon Europe 2030 are accelerating research and deployment.

Asia-Pacific:

Dominating the global market with over 60% share, countries like China, Japan, and South Korea are expanding both production capacity and R&D investment. Leading companies such as Jiangsu Boqian and Do-Fluoride are setting benchmarks in cost efficiency and scale.

South America:

The region, especially Brazil and Argentina, is exploring battery technologies to complement its growing lithium mining sector. While infrastructure is still developing, the potential for integration with local lithium resources is high.

Middle East & Africa:

Early-stage market activity is underway, primarily driven by renewable energy integration projects. Nations such as UAE and South Africa are showing potential, although significant investment in R&D and infrastructure is still required.

View the Complete Report Here : https://www.intelmarketresearch.com/chemicals-and-materials-862

Competitive Landscape

The market is semi-fragmented, comprising both well-established players and emerging innovators. Key players include:

- Sila Nanotechnologies (U.S.): Known for its patented Titan Silicon™ anodes.

- DuPont de Nemours, Inc. (U.S.): Vertically integrated, with advanced processing capabilities.

- Teijin Limited (Japan): Focuses on silicon-carbon composite technologies.

- NanoPow AS (Norway): Specializes in plasma-based, cost-efficient nano silicon production.

- Jiangsu Boqian New Materials (China): A major supplier across Asia, known for high-volume production.

Other notable companies include Kinaltek, Do-Fluoride, Ionic Mineral Technologies, and Enovix Corporation, all pushing the envelope through M&A, R&D, and global partnerships.

Recent Developments

- January 2025: Panasonic invested $200M in Nexeon (UK) to scale porous silicon anode tech for its 4680 cells, set to debut in Tesla and Toyota EVs by 2026.

- May 2025: LG Energy Solution and Group14 announced a $300M JV to develop a factory in South Korea for SCC55™ silicon-carbon anodes, serving GM and Hyundai.

- March 2024: BASF acquired SiNode Systems for $150M, integrating high-performance silicon-graphene anode technology into its EV battery pipeline.

- September 2024: CATL acquired 15% of LeydenJar (Netherlands) to utilize pure silicon foils in upcoming Qilin Gen-3 batteries, supporting triple capacity compared to graphite.

Market Segmentation

By Production Method:

- Physical Vapor Deposition (PVD)

- Grinding / Mechanical Milling

- Chemical Vapor Deposition (CVD)

- Others

By Material:

- Silicon-Carbon Composites

- Nanostructured Silicon Anodes

- Silicon Nanowires (SiNWs)

- Others

By Capacity:

- 0–3,000 mAh

- 3,000–10,000 mAh

- Above 10,000 mAh

By Application:

- Power Battery

- Energy Storage Battery

- Others

By End-Use Industry:

- Consumer Electronics

- Automotive (Electric Vehicles)

- Energy Storage Systems

- Aerospace and Industrial Applications

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Request a Free Sample Copy : https://www.intelmarketresearch.com/download-free-sample/862/Nano%20-Silicon-for-Lithium-Battery-Market

View the Complete Report Here : https://www.intelmarketresearch.com/chemicals-and-materials-862

FAQ Snapshot

Q: What is the projected size of the Nano Silicon for Lithium Battery market by 2031?

A: USD 346 million, up from USD 54.6 million in 2024.

Q: Which companies are key players in this market?

A: Sila Nanotechnologies, DuPont, Teijin, NanoPow, Jiangsu Boqian, among others.

Q: What’s driving the market’s rapid growth?

A: EV adoption, advanced nanomaterial processes, and energy storage demand.

Q: Which region leads the market globally?

A: Asia-Pacific, with over 60% of global production and consumption.

Q: What are the latest market trends?

A: Silicon-dominant architectures, supply chain localization, new coating techniques, and OEM-material supplier collaborations.

Related URL

https://www.intelmarketresearch.com/food-and-beverages/326/vitamin-b9-folic-acid

https://www.intelmarketresearch.com/ict-and-media/323/mid-infrared-optical-fiber

https://www.intelmarketresearch.com/chemicals-and-materials/322/photosensitive-polyimide

https://www.intelmarketresearch.com/food-and-beverages/321/rose-wine

https://www.intelmarketresearch.com/ict-and-media/317/endpoint-backup-software

https://www.intelmarketresearch.com/chemicals-and-materials/320/server-liquid-cold-plate

https://www.intelmarketresearch.com/consumer-goods-and-services/315/oral-rehydration-solution