1. What is Offshore Company Privacy?

Offshore company privacy simply means that when you form a company in another country (offshore), your personal and financial information is kept confidential. Your name doesn’t necessarily appear in public registries. Think of it as putting your sensitive information in a safety deposit box in a different country.

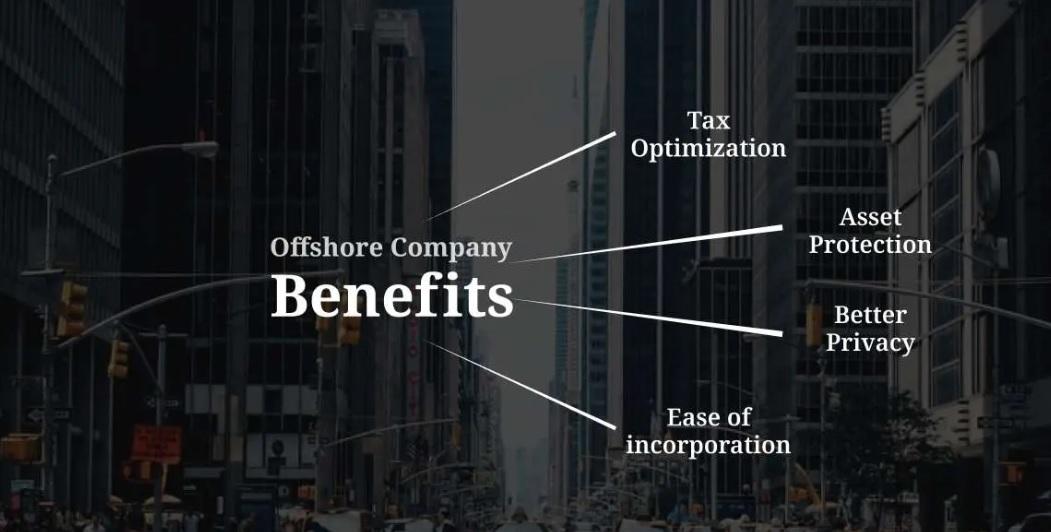

This setup is widely used by entrepreneurs, investors, and businesses to protect their identity, reduce red tape, and enjoy favorable legal environments.

Read Also:- Offshore Company Registration Fast in Singapore?

2. Benefit 1: Enhanced Asset Protection

– Protecting Against Lawsuits

In today’s world, lawsuits can pop up out of nowhere—business disputes, personal claims, or even false accusations. Offshore companies can act as a legal barrier that keeps your personal wealth safe.

If your company is based offshore, creditors may have a tough time accessing your assets. It’s like having a firewall around your finances.

– Shielding Personal Wealth

When your name isn’t directly tied to your business holdings, you reduce your visibility as a financial target. This level of privacy helps ensure that your savings, properties, and investments stay yours, even when legal trouble comes knocking.

Overseas Company Asset Protection and Offshore Company Asset Protection are two of the biggest reasons why people turn to this setup.

3. Benefit 2: Financial Privacy & Confidentiality

– Keeping Ownership Private

Some offshore jurisdictions allow nominee directors and shareholders, meaning your name stays off the public radar. You still control everything, but nobody sees your name attached to the company.

This privacy is particularly helpful for high-net-worth individuals who want to avoid public scrutiny or threats.

– Avoiding Public Disclosure

In many countries, company information like shareholders’ names and financial reports must be submitted to government databases. Offshore companies in privacy-friendly jurisdictions avoid this requirement, ensuring your data stays private.

It’s not about hiding something shady—it’s about keeping your private life, private.

4. Benefit 3: Simplified Administration

– No Need for Complex Bureaucracy

One of the biggest headaches for business owners is paperwork. Offshore jurisdictions often offer Offshore Company Simple Administration, meaning fewer forms, fewer fees, and less time wasted.

Imagine running your business without the red tape—it’s like replacing a typewriter with a smartphone.

– Minimal Reporting Requirements

Some countries demand yearly audits, tax filings, and business reports. Offshore companies in places like Seychelles or Belize often have no annual reporting requirements, making them attractive to busy entrepreneurs.

Less hassle, more time to focus on what truly matters—growing your business.

5. Benefit 4: Global Investment Opportunities

– Operating in Multiple Jurisdictions

Having an offshore company makes it easier to do business internationally. You’re not tied to one country’s rules—you get to pick the best ones.

Want to open a bank account in Switzerland or buy property in Dubai? With an offshore company, it’s not only possible—it’s easy.

– Accessing New Markets

Offshore companies can serve as gateways into new and emerging markets. From Asia to the Caribbean, these structures let you expand globally without jumping through local hoops.

It’s like having a universal adapter for global business.

6. Benefit 5: Lower Tax Burden

– Legally Minimizing Taxes

No one wants to pay more taxes than they have to, right? Offshore companies can help you legally reduce your tax liabilities, depending on the jurisdiction and your business activities.

This isn’t about dodging taxes—it’s about smart planning. Many offshore jurisdictions offer zero or very low corporate tax rates.

– Jurisdiction Selection Matters

Not all offshore countries are created equal. Choosing a tax-friendly jurisdiction like Seychelles or the British Virgin Islands means you can enjoy more of your earnings while staying compliant with international law.

7. Choosing the Right Offshore Jurisdiction

Before setting up an offshore company, you need to choose the right location. Factors like privacy laws, tax policies, political stability, and ease of incorporation play a big role.

Here are a few popular choices:

- Seychelles – Great for asset protection and privacy

- Belize – Simple setup and strong confidentiality

- British Virgin Islands (BVI) – High reputation and global reach

Each jurisdiction has its strengths. Work with professionals to find the best fit.

8. Common Myths About Offshore Companies

Let’s bust some common myths:

- “Only criminals use offshore companies.” – Totally false. Most users are law-abiding entrepreneurs and investors.

- “Offshore means illegal.” – Nope. Offshore companies are legal in most countries, as long as they comply with tax laws.

- “You’ll lose control of your money.” – Not true. You stay in full control of your business and assets.

Don’t let myths cloud your judgment—offshore companies can be ethical, legal, and smart business tools.

9. Are Offshore Companies Legal?

Yes, offshore companies are 100% legal, provided they are not used for illegal purposes like money laundering or tax evasion.

They are just businesses formed in a different country—something that’s been done for decades by large corporations and small startups alike.

The key is compliance: make sure you’re following the laws in both your home country and the offshore jurisdiction.

10. Conclusion

Let’s wrap it up. Offshore company privacy is more than just secrecy—it’s about control, security, and freedom. Whether you want to protect your assets, enjoy simplified administration, or take advantage of tax benefits, an offshore company can be your golden ticket.

Remember: it’s not about hiding, it’s about smart structuring.

With benefits like Overseas Company Asset Protection, Offshore Company Asset Protection, and Offshore Company Simple Administration, going offshore is no longer just for the rich and powerful—it’s for anyone who wants to take control of their financial future.

Frequently Asked Questions (FAQs)

1. Is it legal to open an offshore company?

Yes, forming an offshore company is completely legal as long as it’s not used for unlawful activities like tax evasion or fraud.

2. How does offshore privacy protect my assets?

Offshore structures separate your personal identity from your assets, making it harder for creditors or lawsuits to reach them.

3. Do I have to live in the country where I form my offshore company?

No, many offshore jurisdictions allow non-residents to form and operate companies remotely.

4. Can an offshore company help me save taxes?

Yes, many offshore jurisdictions have favorable tax policies that can legally reduce your tax liabilities.

5. Is managing an offshore company complicated?

Not at all. Many offshore jurisdictions offer Offshore Company Simple Administration, which requires minimal paperwork and ongoing compliance.